Buying Precious Metals from BGASC

Rules and Regulations by State

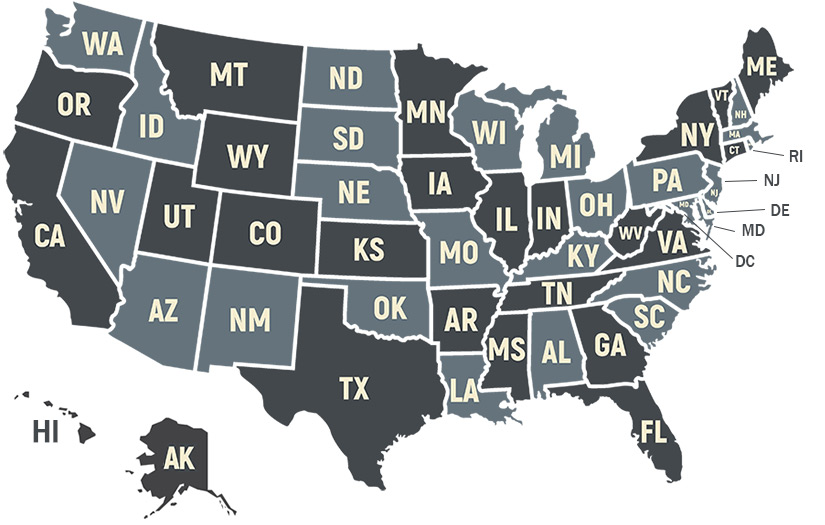

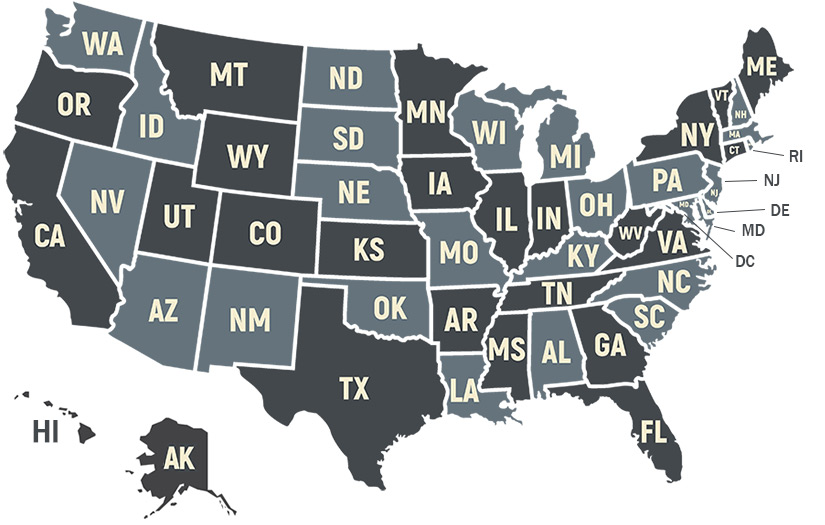

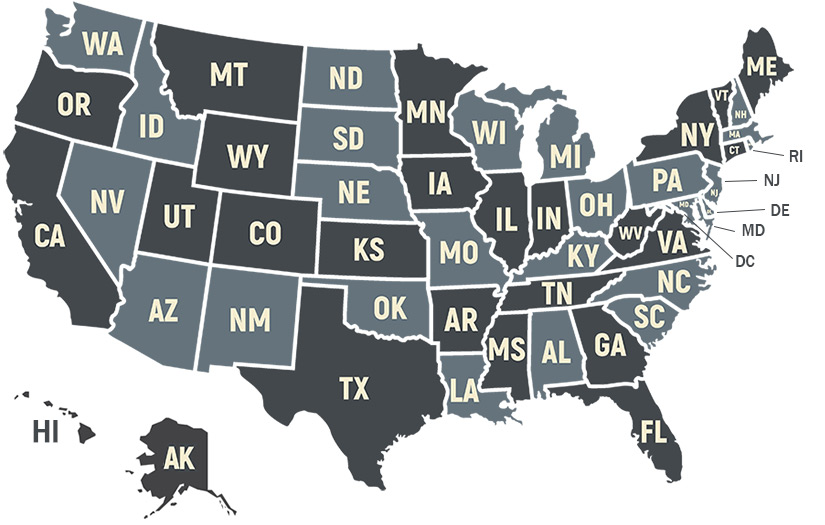

At BGASC, our goal is to provide transparency and clarity throughout your purchasing experience. To help you better understand your applicable sales tax obligations, we’ve created an interactive sales tax map (above). This tool allows you to explore the specific tax rules and regulations for your shipping destination, ensuring you know what to expect before completing your purchase.

Key Considerations:

– Sales tax is charged only in select states.

– Tax applicability varies based on product type. For example, many states exempt coins from sales tax, while others may apply tax.

– Sales tax is based on the shipping destination.

This is subject to change at any time without notice.